AI to Categorize Bank & Credit Card Transactions

3 min. read

3 min. read

If you have ever manually categorized a lot of bank or credit card transactions, you know how tedious this process can be. Generally speaking, you need to get a digital copy of the statement, then maybe try to get it into a program like Excel or Google Sheets so that you can look at each transaction and categorize it. Maybe each transaction needs to be tagged to a department, or perhaps it needs to be flagged as personal or business related. Whatever the actual categorization reason, the process is time consuming, and prone to error.

Recently, a client reached out asking if there was a way for us to enable new functionality in their internal management system to extract expense items from credit card statements, and automatically tag them to the correct categories so that the transactions can be further processed based on the categorizations applied. After a quick discovery round, we outlined a solution that would allow their existing system to communicate with a dedicated microservice that performs the processing of documents and prediction on each transaction.

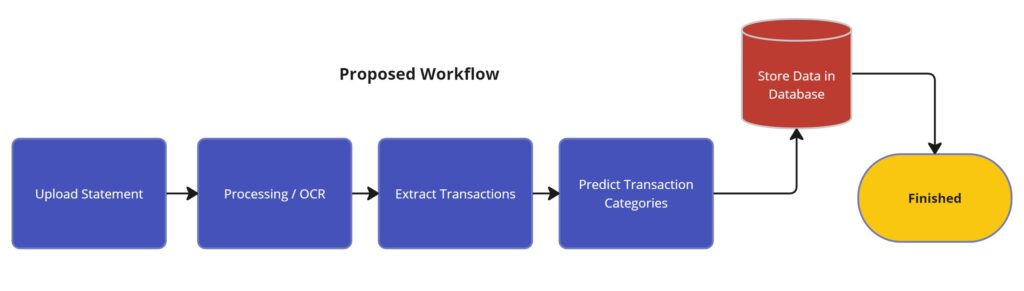

As shown in the above diagram, the workflow outlines a process that begins by the document being received by the microservice, and ends with the categorized transactions being stored in a database. The architecture diagram below illustrates how the existing management system was maintained, and a couple new microservices that run outside of the main portal handles the processing and tagging of transactions. From there, the main platform eventually reads that data and includes it in the organization’s regular reporting workflows through the main portal.

To achieve the above solution, we created two microservices to handle document processing tasks and to perform the actual categorization of each transaction.

If your organization needs to extract and process information from unstructured documents like bank or credit card statements, feel free to contact Wired Solutions to discuss how we can help.